How Much Is Inheritance Tax 2025 In Pa. Use the form below to calculate pa inheritance tax due from an estate transfer. Labour is expected to increase the amount of money it makes from inheritance tax at the budget, according to reports.

Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. Inheritance tax is paid out of a person’s estate after that person dies.

How Much Is Inheritance Tax In Pa 2025 Hildy Latisha, Inheritance tax is paid out of a person’s estate after that person dies.

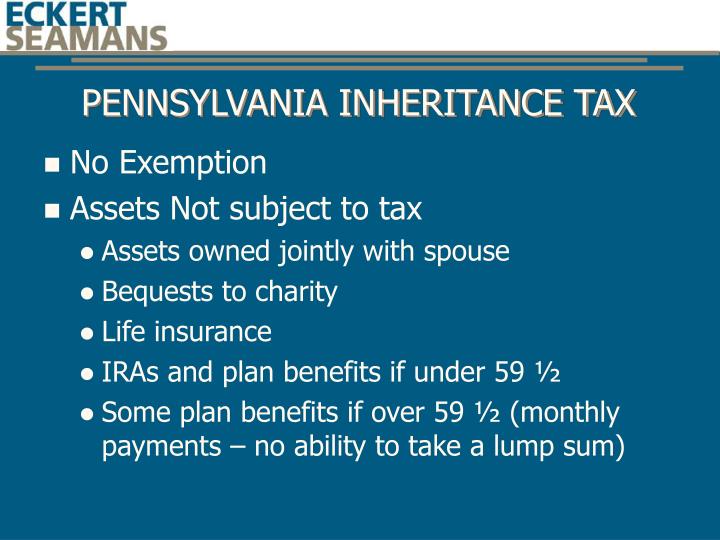

How Much Is Inheritance Tax 2025 Esther Roxanne, The tax rate for pennsylvania inheritance tax is 4.5% to 15%.

How Much Is Inheritance Tax In Pa 2025 Niki Teddie, This category includes the deceased person's:

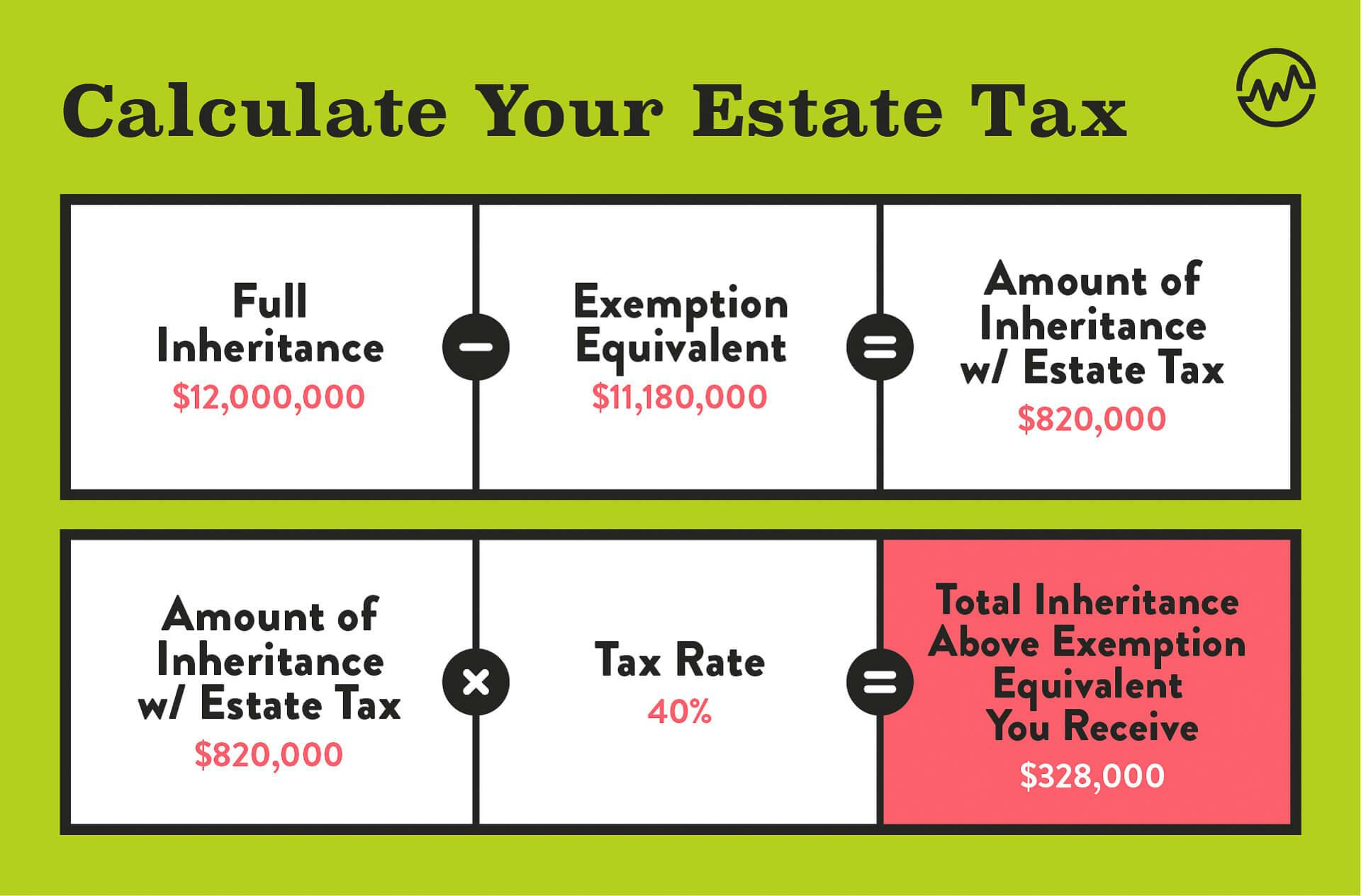

Understanding & Addressing an Estate Tax Liability Anchor Capital, Let's break down who has to pay it, how much and how to minimize it.

How much inheritance tax you will pay in 2025 and what you can do, The estate could be in the form of property, possessions or money.

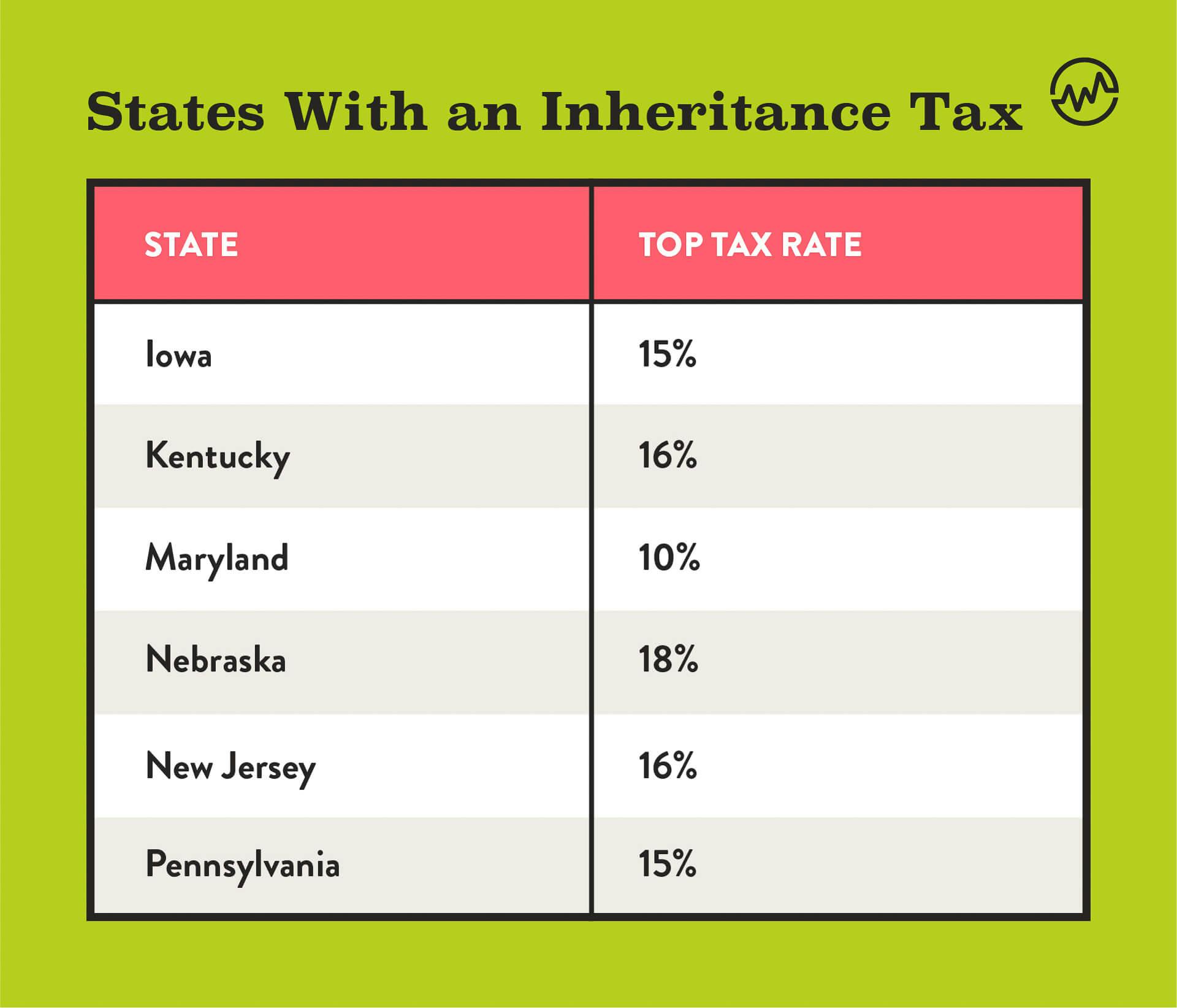

State Estate Tax Rates & State Inheritance Tax Rates Tax Foundation, In 2025, the first $13,610,000 of an estate is exempt from the estate tax.

Tax rates for the 2025 year of assessment Just One Lap, The tax rate for pennsylvania inheritance tax is 4.5% to 15%.