How To Calculate Federal Tax Withholding 2025. From july 1, 2025, through june 30, 2025, the illinois motor fuel tax rates (in cents per gallon, dge 1, or gge 2) are as follows: How to calculate federal tax based on your annual income.

How to calculate net income. Use the payroll deductions online calculator (pdoc) to calculate federal, provincial (except for quebec), and territorial payroll deductions.

2025 Bracket Matrix Calculator Helge Brigida, Enter your income and location to estimate your tax burden. The 2025 tax calculator uses the 2025 federal tax tables and 2025 federal tax tables, you can view the.

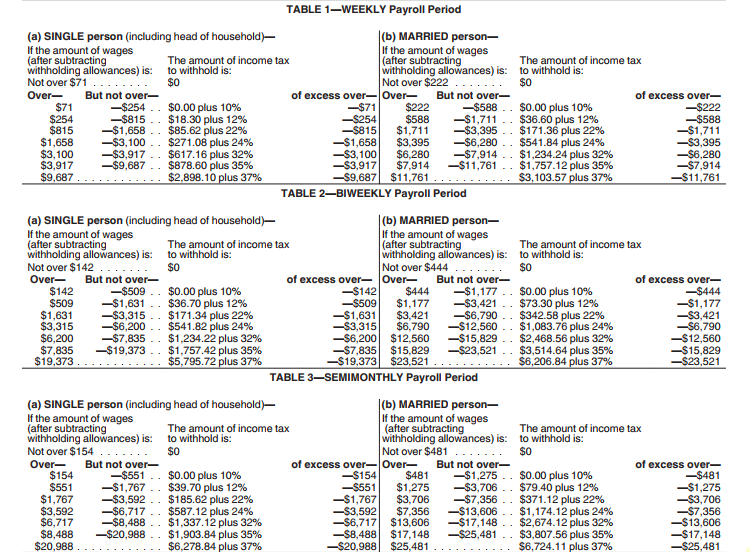

Federal withholding tax table Wasdel, Use the payroll deductions online calculator (pdoc) to calculate federal, provincial (except for quebec), and territorial payroll deductions. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes.

How To Calculate, Find Social Security Tax Withholding Social, —withholds 6.2% of all of your income up to. The federal income tax calculation includes standard deductions.

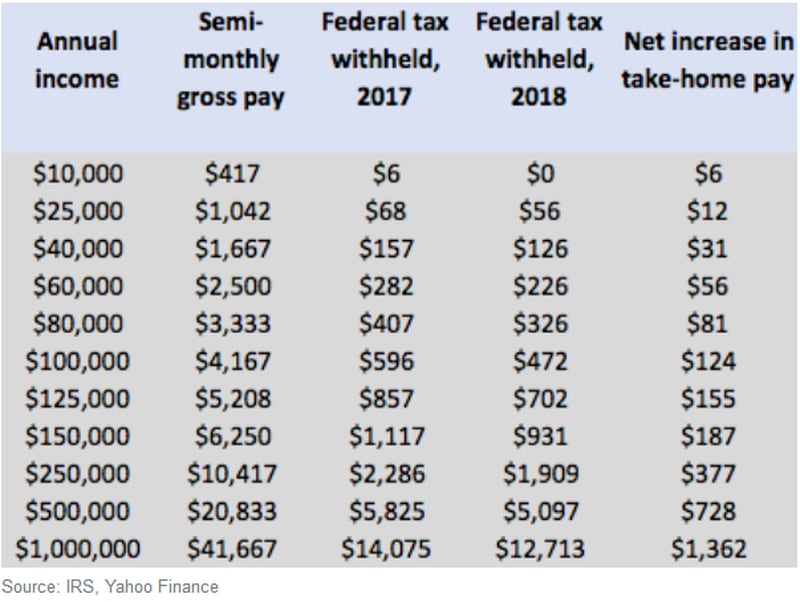

Here's why there's more money in your paycheck, If you make $70,000 a year living in wisconsin you will be taxed $10,401. Updated for 2025 (and the taxes you do in 2025), simply.

How to calculate payroll taxes 2025 QuickBooks, —withholds 6.2% of all of your income up to. How to calculate federal tax based on your annual income.

Annual federal withholding calculator KerstinKeisha, How to calculate net income. The federal income tax calculation includes standard deductions.

세 종류의 각 소득에 대한 택스는?, Enter your weekly salary, filing status and select a state for instant federal and state tax deductions for 2025. Your federal income tax withholding depends on what tax bracket your income places you in.

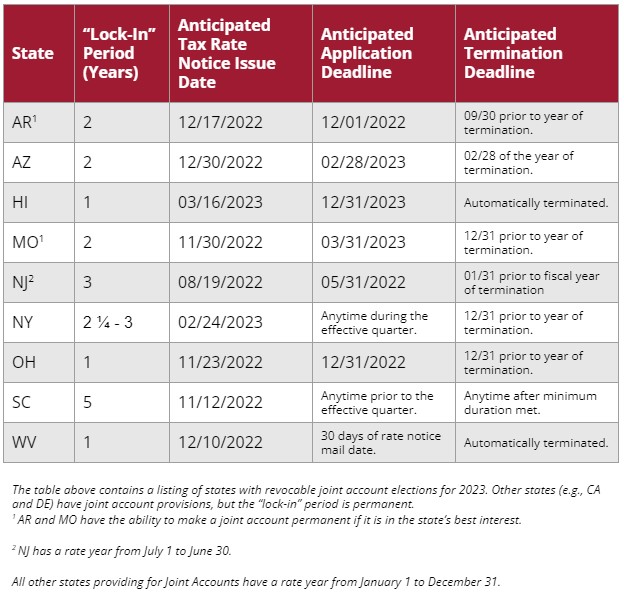

How To Calculate 2025 Tax Refund PELAJARAN, There are two federal income tax table methods for use in 2025—the. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

How to Calculate Payroll Taxes for Your Small Business, It will confirm the deductions you. How to calculate net income.

How to Calculate Federal Tax, More money now or refund later? Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2025 tax return in 2025.

Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.